If the thought of doing your taxes this year makes you feel like running in the other direction, a service offered at the Camas Public Library on Wednesday and Thursday afternoons might be able to help.

The American Association of Retired Persons (AARP) Foundation offers a free tax preparation service known as Tax-Aide at several Clark County library branches through Tax Day on April 15.

In Camas, the service is offered from noon to 4 p.m., every Wednesday and Thursday, through April 11, in Meeting Room A on the second floor of the Camas library, at 625 N.E. Fourth Ave., in downtown Camas.

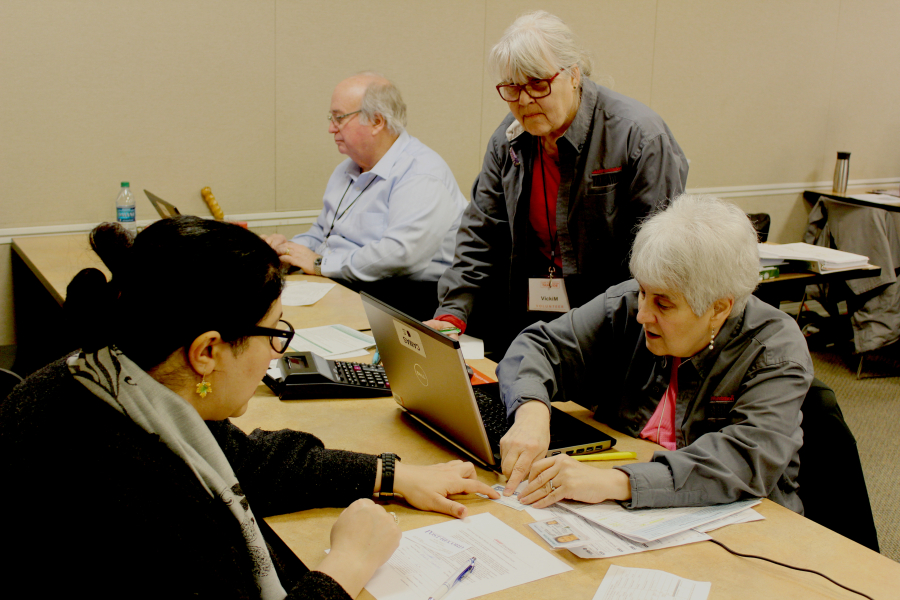

Roger Noah, of Washougal, is one of the volunteer AARP Tax-Aide counselors that helps folks figure out the convoluted world of tax preparation — for free — at the Camas library.

A retired certified public accountant (CPA) with a tax background, Noah said he, like many of the Tax-Aide volunteers, wanted to find a way to stay busy and give back to his community during his retirement years. The Tax-Aide program made sense. He volunteered with the program for two years in Oregon before helping people on the north side of the Columbia River in Clark County a year ago.